OUR PRODUCTS

Promoter Funding

Promoter Funding helps business owners raise capital by infusing personal or institutional funds into their company. This solution strengthens equity, addresses short-term capital needs, and enables growth. We assist in structuring and securing funding to meet your business’s specific needs.

Structured Financing

Structured Financing tailors capital solutions using a mix of debt, equity, and other financial instruments to suit unique business needs. We create customized funding solutions to help your business grow while managing risks and optimizing returns.

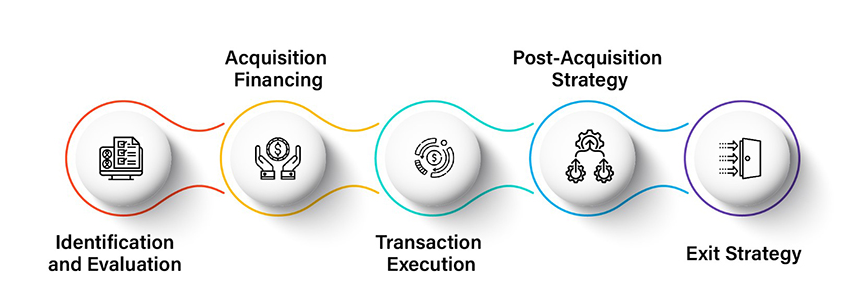

Acquisition Financing/Bridge Financing

Acquisition Financing enables businesses to acquire assets or companies, while Bridge Financing offers short-term funding until long-term solutions are in place. We help structure these financial options for smooth, strategic growth and seamless transactions.

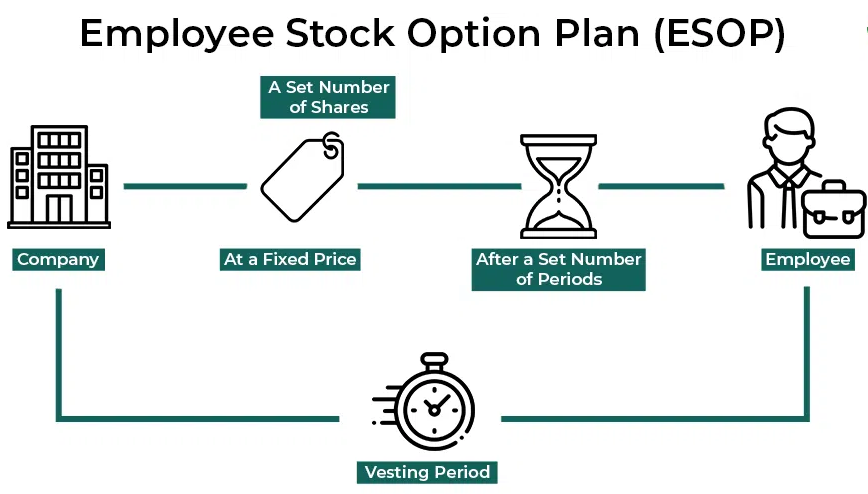

ESOP Financing & Solutions

We help businesses set up and finance Employee Stock Ownership Plans (ESOPs), providing funding and structuring solutions that align with your company’s goals and regulatory requirements. ESOPs can incentivize employees and offer owners a clear exit strategy.

Private Equity Funding

Private Equity Funding offers businesses access to capital without going public. We connect you with private equity investors to raise funds for growth, acquisitions, or restructuring while ensuring favorable terms and an optimal investment strategy.

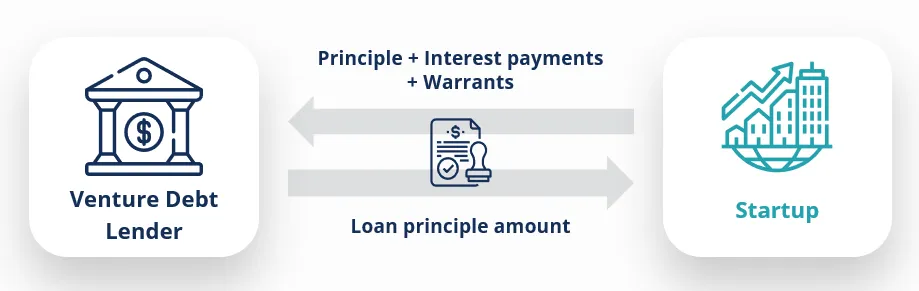

Venture Debt

Venture Debt is a financing option for early-stage companies needing capital without giving up ownership. We guide businesses through venture debt solutions, balancing the need for funding with long-term sustainability.

External Commercial Borrowings (ECBs)

External Commercial Borrowings (ECBs) are loans raised from international sources to fund domestic operations. We assist businesses in navigating ECBs, ensuring compliance with regulations and securing cost-effective global capital.

Leveraged Buyout (LBO)

A Leveraged Buyout (LBO) involves acquiring a company using borrowed funds, repaid through the acquired company’s cash flow. We offer strategic advice and financing to help execute successful LBOs, ensuring optimal financial structure and growth potential.

Feasibility Study & Project Report

Our Feasibility Study and Project Report assess the viability of new ventures or projects. We analyze market conditions, financial viability, and risks to provide data-driven insights that guide informed decisions and minimize investment risks.